Payroll management is crucial for freelancers, small businesses, and independent contractors. However, errors in calculations, tax deductions, or record-keeping can lead to financial issues. A paycheck creator free tool simplifies payroll processing by ensuring accuracy, reducing human error, and maintaining compliance with tax regulations.

This blog explores how a free paycheck creator enhances payroll accuracy, its key benefits, and why it is essential for freelancers and businesses.

The Importance of Payroll Accuracy

Payroll accuracy is essential because:

Avoids Tax Penalties – Incorrect tax calculations can lead to fines.

Ensures Employee Trust – Paying employees correctly fosters a positive work environment.

Prevents Financial Errors – Mistakes in payroll can disrupt budgeting and cash flow.

Provides Legal Compliance – Accurate records help in audits and compliance with labor laws.

How a Paycheck Creator Free Tool Enhances Accuracy

1. Automated Calculations

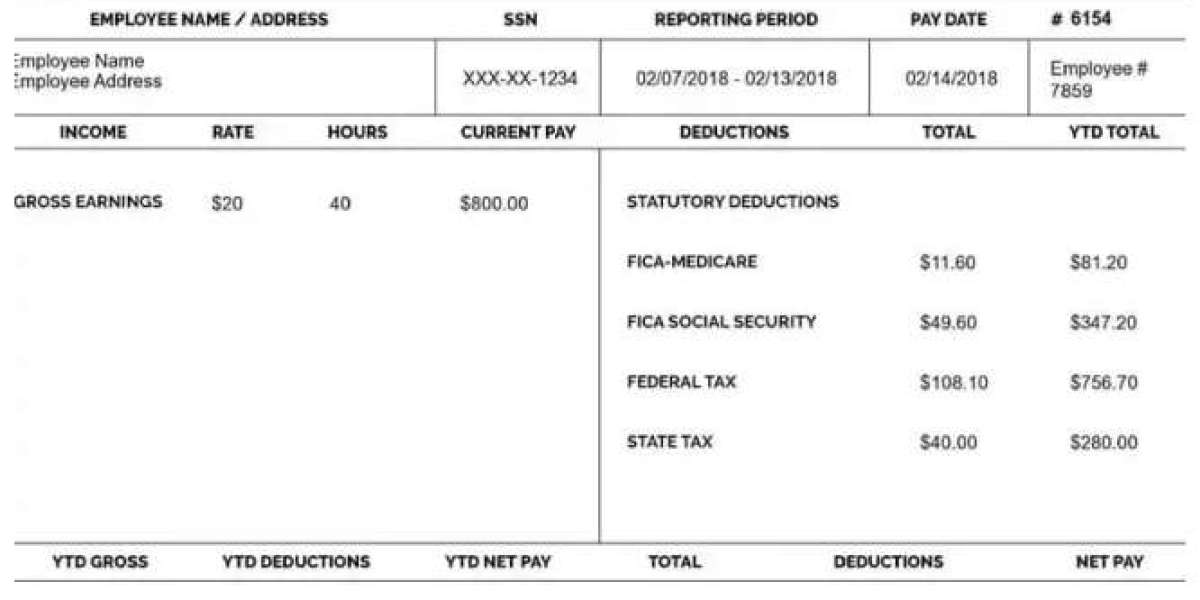

A paycheck creator free tool automatically calculates wages, deductions, and taxes, eliminating manual errors.

2. Error Reduction in Tax Deductions

It ensures that federal, state, and local tax deductions are accurate, preventing miscalculations.

3. Consistent Payment Records

By generating pay stubs instantly, it keeps a clear record of all payments, useful for audits and tax filing.

4. Customizable Fields

Freelancers and business owners can enter specific earnings, deductions, and other details, ensuring precise payroll processing.

5. Time Efficiency

A paycheck creator simplifies payroll processing, saving valuable time that can be used for business growth.

Key Features of a Reliable Paycheck Creator Free Tool

User-Friendly Interface – Easy to use, even for those without accounting experience.

Automatic Tax and Deduction Calculations – Ensures compliance with tax regulations.

Downloadable Pay Stubs – Provides instant access to payroll records.

Cloud Storage – Keeps payroll history safe and organized.

Benefits for Freelancers and Small Businesses

Proof of Income – Essential for loan applications, rentals, and tax filing.

Financial Organization – Helps keep track of earnings and expenses.

Professionalism – Makes freelancers and small business owners look more credible.

Tax Readiness – Keeps payroll records organized for hassle-free tax filing.

Conclusion

A paycheck creator-free tool is a must-have for freelancers and small businesses, ensuring payroll accuracy, reducing errors, and improving financial transparency.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?

Role of Financial Management in Creating a Stable Paycheck