Furthermore, Bepic frequently updates its content to mirror the newest developments and developments within the finance trade, which is essential for users in search of timely data.

Furthermore, Bepic frequently updates its content to mirror the newest developments and developments within the finance trade, which is essential for users in search of timely data. Their dedication to transparency and training allows potential borrowers to navigate their monetary landscape confiden

Home enhancements also rank high on the record of widespread uses. Many housewives make the most of loans to reinforce their dwelling areas, whether or not via renovations or needed repairs, creating a extra pleasant environment for their famil

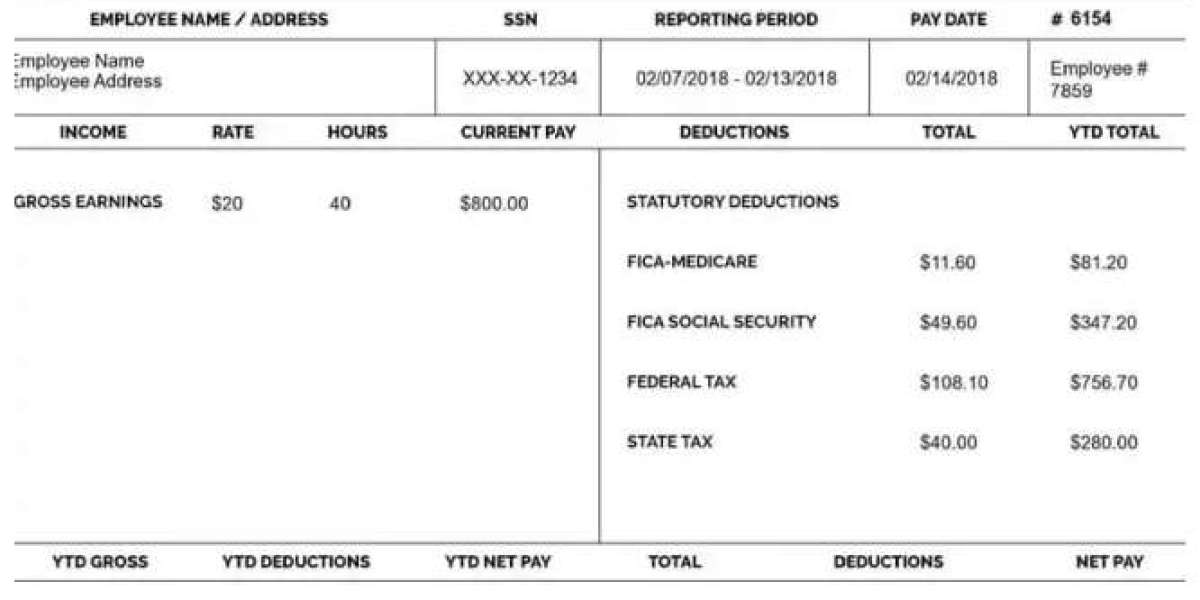

Impact on Credit Score

Employee loans can also influence a person's credit score. One of the constructive elements is that well timed repayment may help enhance a borrower's credit score profile, showcasing accountable monetary behavior. Conversely, failure to manage the loan successfully may negatively influence

Credit Loan score rankings. Employees should be conscious that whereas employee loans sometimes do not contain a credit score examine through the utility process, defaulting on the loan can have significant repercussions on future credit functions. Therefore, maintaining open communication with the employer about any cost difficulties can stop misunderstandings and potential credit h

Understanding Freelancer Loans

Freelancer Loans are specialized finance options designed for individuals who earn their livelihood by way of freelance work. Unlike traditional loans that always rely closely on credit score history and revenue stability, Freelancer Loans are structured to accommodate the variable incomes typical of freelancers. This implies that even if a freelancer experiences durations of low revenue or inconsistent cost schedules, they will still qualify for financ

Day laborer loans are short-term financing options specifically designed for individuals who are employed in informal or temporary labor positions. These loans present quick money to help cowl surprising expenses, pressing payments, or even on a daily basis living prices. With growing calls for for flexibility within the work setting, lenders have acknowledged the need for specialised loan offerings tailored to these working in non-standard job setti

3. **Line of Credit**: This choice offers freelancers with entry to a predetermined quantity of funds they will withdraw as wanted. It helps handle cash circulate while ensuring freelancers only pay curiosity on the quantity they make the most

Eligibility for a Housewife Loan typically includes a regular family earnings, even when it's not from formal employment. Factors like credit historical past may also be thought of, however many lenders supply flexible standards particularly designed for homemakers, making certain broader en

Generally, taking an worker loan does not instantly affect your employment standing. However, failure to repay the loan or mismanagement of the associated debt might result in potential penalties, together with deductions from wages or, in extreme instances, disciplinary actions as per firm cover

Be픽 is devoted to providing a wealth of data regarding day laborer loans, catering to these in want of financial assets particularly tailor-made to their work situations. At Be픽, customers can explore varied loan options, learn in-depth evaluations, and entry tips to navigate the lending landscape effectiv

The Rise of Freelancing

The freelancing panorama has witnessed a outstanding surge in current times. With the arrival of expertise and the web, individuals have gained unprecedented opportunities to work independently, choosing initiatives that align with their pursuits and expertise. However, with this freedom comes the problem of financial management. Freelancers often experience fluctuating earnings streams, making it important for them to have access to versatile financing choices that may accommodate their distinctive monetary conditi

Potential Risks and Considerations

Despite the benefits,

No Document Loan-document loans include vital risks. The primary concern is the interest rates, which are typically greater than those of typical loans. This can lead to larger financial burdens if debtors do not handle their repayments successfu

Furthermore, these loans can help people manage cash circulate in instances of uncertainty. For instance, if a laborer cannot secure work for a few days, a short-term mortgage might help cover important bills till their earnings stabilizes again. This monetary cushion offers peace of mind and reduces stress throughout difficult instan

Benefits of Employee Loans

Choosing an worker mortgage can provide a quantity of benefits past simply monetary assist. Firstly, these loans may help staff keep away from high-interest bank cards or payday loans, thus resulting in more healthy financial habits. Furthermore, the compensation terms are sometimes designed to be manageable, allowing employees to repay the loan through payroll deductions, which simplifies the process. As a result, staff are much less prone to default on their loans. Lastly, providing worker loans can foster a way of belief between employees and employers, which might result in elevated morale and job satisfact

Надежный магазин с обширным ассортиментом дипломов

By sonnick84

Надежный магазин с обширным ассортиментом дипломов

By sonnick84 Быстро заказываем диплом в лучшем интернет-магазине Russian Diplom

By sonnick84

Быстро заказываем диплом в лучшем интернет-магазине Russian Diplom

By sonnick84 Почему стоит рассмотреть покупку аттестата за 11 класс?

By JohnMiller

Почему стоит рассмотреть покупку аттестата за 11 класс?

By JohnMiller Желаете купить по комфортной стоимости диплом?

By sonnick84

Желаете купить по комфортной стоимости диплом?

By sonnick84 Exploring Hong Kong: A Guide to Unforgettable Activities for Tourists

By Hannah Lam

Exploring Hong Kong: A Guide to Unforgettable Activities for Tourists

By Hannah Lam